Intro

Hello, and welcome back!

This is part 2 of a 3-part series: What is an NFT? Each article is written for a general audience. We will explore concepts related to NFTs, including how you can interact with, create, buy your very own.

The series consists of:

Introduction (Surface level overview on “all things NFT,” and an invitation for you to stay here a while, through the series)!

Technical (What, on the back-end, makes NFTs possible). ←You are here

Practical (What is available on the front-end, and how you, and everyone, can engage with NFTs, including creating your very own). ←Coming Jan 15 - 25, 2022

In this entry, 2) What is an NFT? — Technical, I will touch on the most essential back-end components of NFTs, all of which relate to the blockchain. This will help us further develop our understanding of NFTs.

Welcome back, glad you are here, and let’s get right to it!

Learning the Blockchain

There was a tech innovation, called the blockchain, which was leveraged to create NFTs. The blockchain was not created so that NFTs specifically could be created — but NFTs are a byproduct and clever application of the new tech.

So what is the blockchain, and what is so innovative about it?

First, we’ll answer what it is. A blockchain is a database!

And the unique thing about a blockchain — the innovation compared to other databases — is the way in which it stores data.

That general concept is all we need to know for now. Let’s hold off on diving further into specifics for a bit.

Summary: The blockchain, which is a database, differs from other databases in a unique and innovative way based on how it stores its data. More later.

How the Blockchain Relates to NFTs

Taking from the house example in 1) What is an NFT? — Introduction, you can think of the blockchain essentially as the “physical” location of a digital thing. Once the digital thing has “land” that it lives on, it can be designated unique, ownable, and therefore, tradeable. Compared to other databases, the blockchain is thought to provide a bit more security, transparency, and “democratic” approach to changing entries in the database, to complete transactions.

Explaining Cryptocurrencies

NFTs and cryptocurrencies are not the same — though they share similar features, and often will work together. It is often the case that if you buy an NFT, you will first need some cryptocurrency (ie. ETH for buying NFTs on the Ethereum blockchain). Let’s discuss a bit more about what cryptocurrency is.

Most blockchains offer some concept of a “coin” or cryptocurrency that may have a finite(-ish) supply, along with other features that aim to make it a currency, or medium of exchange.

Note that most cryptocurrencies are not even close to being currencies by any reasonable definition that most of us be used to. And, frankly, they may never get there. This is because of their price volatility. Here is one example, pictured below: The volatile price of one of the most stable cryptocurrencies, Bitcoin (BTC).

If you bought Bitcoin at any point within the past 5 years, you may have grown your money by 5x, or even 10x… or if you were unlucky with timing, you may have lost 50% of your initial investment. The price is volatile, therefore making it an interesting investment, but not a currency by most reasonable definitions.

In 3) What is an NFT? — Practical, I will review how you can transact on the blockchain. This will include how you can acquire and spend cryptocurrency in order to buy an NFT. Note that some services offer help in converting USD$ to the relevant cryptocurrency roughly at the time of transaction. For example, Top Shot does this. Top Shot is the product and service for NFTs of the NBA. It was created by Dapper Labs, which is a company working in the blockchain space. Top Shot NFTs are listed on the Flow blockchain, which was also invented by Dapper Labs. When buying Top Shot, you don’t need to hold any cryptocurrency — you can buy Top Shot NFTs in USD$ with a credit card. But currently, most other services will require you to already have some cryptocurrency to buy something. Again, more on this coming in 3) What is an NFT? — Practical.

Perhaps, eventually, cryptocurrencies will stay within a more narrow price band, and then they can be considered a currency more broadly (ie. Enabling you to go buy medicine, groceries, etc. at your local market using cryptocurrency). For now, they ought be considered digital assets or investments due to their lack of reliability in value, even if in a relatively small number of cases they can be considered a medium of exchange. To further illustrate the difference: Just like it would not be considered standard to pay for medicine at your local market directly in shares of AAPL (Apple stock), you wouldn’t pay for medicine with crypto yet, either. Along with its price volatility, this is why crypto ought be considered an investment, and not necessarily a currency, broadly. No cryptocurrency is widely accepted as a form of payment, yet. Note that a long term goal for some is for certain cryptocurrencies to be considered a currency, broadly, and not an investment.

Here is yet another example of the volatility of crypto value: Over the timespan that it took me to write this article, the value of all cryptocurrencies fluctuated +/- 10% or more! Perhaps in that same time, the value of the United States Dollar (USD$, the most widely exchanged currency in the world) fluctuated <1%.

And I didn’t take that long to get this published :).

Summary: Cryptocurrency helps you pay for things on the blockchain. Most cryptocurrencies are volatile in price, and not widely accepted as a medium of exchange outside of a very specific context. You can buy an NFT using ETH on the Ethereum blockchain. But just like you can’t buy groceries with AAPL (Apple) shares, you can’t buy groceries with ETH either. Cryptocurrency could be called “the other thing” (besides NFTs) that the blockchain has become widely associated with over the past few years.

Now let’s explore some of the different blockchains currently out there.

Exploring Specific Blockchains (and Associated Cryptocurrencies)

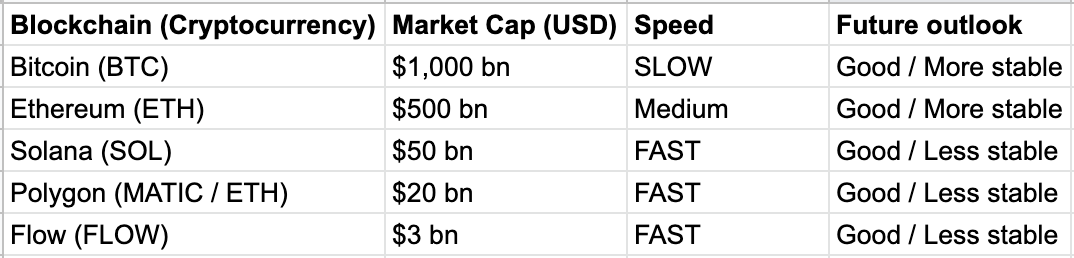

As noted, there are many different blockchains. They all have different features, strengths, and weaknesses.

Here is one specific real example of how understanding the differences between blockchains served me: I recently created an NFT and listed it for sale. I was able to reduce my fees for listing by USD $350 simply by learning the difference between minting an NFT on the Ethereum blockchain vs. on the Polygon framework and applying that knowledge. I will cover more about the story of listing that item in 3) What is an NFT? — Practical!

Here is a list of specific blockchains that are currently popular, and notes about their features. Note that this list is not intended to be entirely comprehensive, as there are 50+ blockchains which could be considered “popular”:

The Bitcoin Blockchain

Cryptocurrency: Bitcoin (BTC)

BTC is the largest cryptocurrency by Market Cap (~$1 tn).

Other Application / Utility

Not much… It seems that the Bitcoin Blockchain is mostly only used for BTC.

Notes and Known Issues

At a maximum rate of only 5 transactions per second, the Bitcoin blockchain is very old and slow!

Bitcoin is known as the first major blockchain innovation — invented by someone under the name Satoshi Nakamoto in 2009.

The Bitcoin blockchain was associated with high energy consumption. That is because in order to transact on the Bitcoin Blockchain, complex mathematical problems must be solved. Supercomputers with enormous computing power are used to solve these problems, and facilitate transactions. This concept is typical of blockchains — in fact, this Proof of Work is essentially the major innovation of the blockchain over other databases. But other blockchains have improved in efficiency in completing transactions.

Ethereum

Cryptocurrency: Ether (ETH), etc.

Ether is the second largest cryptocurrency by Market Cap (~$500 bn).

Other Application

Home to lots of NFTs!

Notes and Known Issues

Ether (ETH pronounced “eeth”) is often known colloquially as Ethereum — technically, this is wrong. The cryptocurrency is called Ether, or ETH, and Ethereum is the name of its blockchain.

The Ethereum blockchain is faster than Bitcoin, but slower than most other blockchains at about 30 transactions per second!

Ethereum requires “gas fees” to “move around” (facilitate transactions). An analogy would be gas for a car to drive from point A to B. At the time I am writing this, it would cost me about USD$350 to sell an NFT on the Ethereum blockchain using traditional methods (moving the NFT from A to B).

The Ethereum blockchain could probably be considered the “original NFT blockchain.” It was used very early to facilitate minting (creating) / buying / selling most NFTs.

Currently, the Polygon framework is called a “Layer 2” solution on top of the Ethereum blockchain, and is able to facilitate many more transactions per second without charging gas. Ethereum 2.0 is also currently being worked on with the same goal of speeding up transactions and decreasing costs.

Polygon, Solana, Flow, etc.

Cryptocurrencies: MATIC for Polygon, SOL for Solana, and FLOW for Flow

Market Caps from $1bn to $50bn+.

Other Application

NFTs!

Note: Some crypto owners consider buying a cryptocurrency like “investing” in its blockchain! So even if a user will not need MATIC crypto in order to buy or sell on Polygon, this does not mean by any stretch that it should not be considered a valuable coin. Currently, generally ETH is accepted to buy NFTs via Polygon.

Notes and Known Issues

Newer blockchains are basically intended to iterate and solve issues discovered on earlier blockchains. There is said to be a “trilemma” with the blockchain that is talked about constantly in blockchain communities: Fast, secure, or Scalable — choose 2. Newer blockchain solutions attempt to offer all three.

All of these blockchains seem to offer benefits for speed, costs, and thus scale vs. Ethereum, and certainly vs. Bitcoin. Basically, they can facilitate more transactions in the same amount of time and / or are cheaper!

Fragmentation — there are more and more blockchains by the day. This means that solutions leveraging the technology will need to keep up with the pace of innovation of the technology.

Briefly, Another Important Concept — Proof of Work

Above, I mentioned a few instances of calling a blockchain slow, or even expensive. What causes this expense? It is called proof of work: Essentially the method that the blockchains use to ensure the integrity of any changes made to its database (ie. Transactions). This is one of the selling points of blockchain as a Tech innovation, and why it’s considered secure and “democratic.”

Closing Thoughts

Thank you for sticking with me through Part 2! That was a tough one, as we introduced more Technical concepts. In another world, I spend time in this article defining databases, distributed databases, nodes, networks, algorithms, and so on. I will not at this time go in depth on those topics. This article is meant to briefly introduce the technical components to NFTs, and give simple and relatable explanations.

Yesterday I listed an NFT for sale on OpenSea!

In 3) What is an NFT? — Practical, I will take you all through the journey with me and my business partner, sharing how we set it up. In Part 3, my goal will be to share our story, and teach you how you could sell an NFT. Of course, I will be here to help! Until then, thanks again and let me know your questions.

My Goals with this Written Piece

Why am I writing this series? I aim to:

Build community around NFT x digital asset innovation x markets in the discussion thread.

Position myself as an authority / someone to listen to in this space!

Intended Audience

Those looking to learn more and / or be involved in discussion about NFTs. But also…

Those who don’t currently understand NFTs.

Self identified

Anyone who mocks them — particularly if you’ve ever screenshot an NFT and said “Hey, look, I have an NFT!” This is for you lol

If you enjoyed this, please consider supporting me on Patreon. Output of content like this will be directly tied to the attention it is receiving, and support I am getting. My attention is directed toward where I am incentivized to send it.

What’s Next?

With Parts 1 and 2 published, what remains is…

3) What is an NFT? — Practical (Published Jan 15, 2022)

I’m REALLY excited for this piece, as I will tell a story and take you on the journey with me from idea inception to development of a business partnership to minting our NFT and listing the first Wolin Blockchain item for sale on OpenSea.

Thank you for your time! I’d love to hear from you — please comment below questions, thoughts, etc. While this should be viewed as an authoritative piece for what is included, none of this should be viewed as final (ie. For things I left out). There is a lot to say, the space is always growing, and I’d welcome more thoughts.

Until part 3…

Appendix

-NFTs may come with a variety of utility, in addition to being known as a piece of art. There is utility in many NFTs associated with gaming — and that is a space I am expecting to see grow, at least as significantly as the NFT art space, in the coming years: NFTs that unlock your ability to perform some action in video games. You would be able to buy those NFTs with the blockchain’s cryptocurrency.